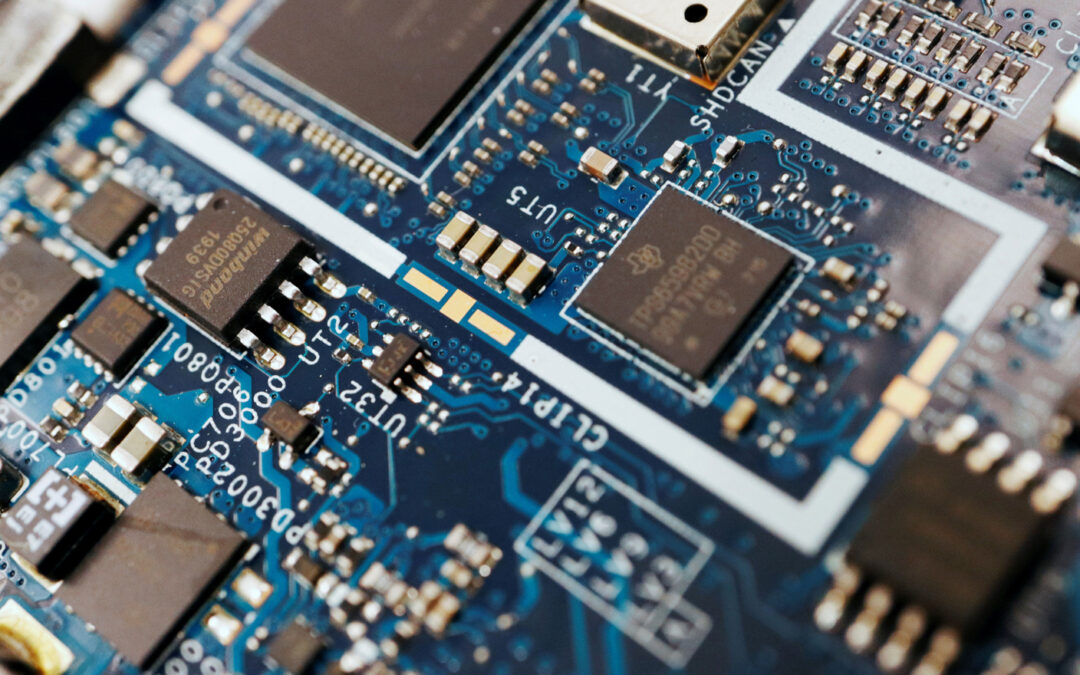

A U.S. effort to bolster domestic semiconductor manufacturing is likely to spur more private equity investment in the capital-intensive industry and the businesses that support it, industry sources told S&P Global Market Intelligence.The CHIPS Act signed into law Aug. 9 by President Joe Biden is expected to channel roughly $280 billion over the next decade into domestic semiconductor science and production, including $52 billion targeted at manufacturing and $200 billion for research. It creates a 25% tax credit for investment in advanced chipmaking facilities.

A U.S. effort to bolster domestic semiconductor manufacturing is likely to spur more private equity investment in the capital-intensive industry and the businesses that support it, industry sources told S&P Global Market Intelligence.The CHIPS Act signed into law Aug. 9 by President Joe Biden is expected to channel roughly $280 billion over the next decade into domestic semiconductor science and production, including $52 billion targeted at manufacturing and $200 billion for research. It creates a 25% tax credit for investment in advanced chipmaking facilities.

Source: Semiconductors ripe for private equity after CHIPS Act | Private Equity Insights