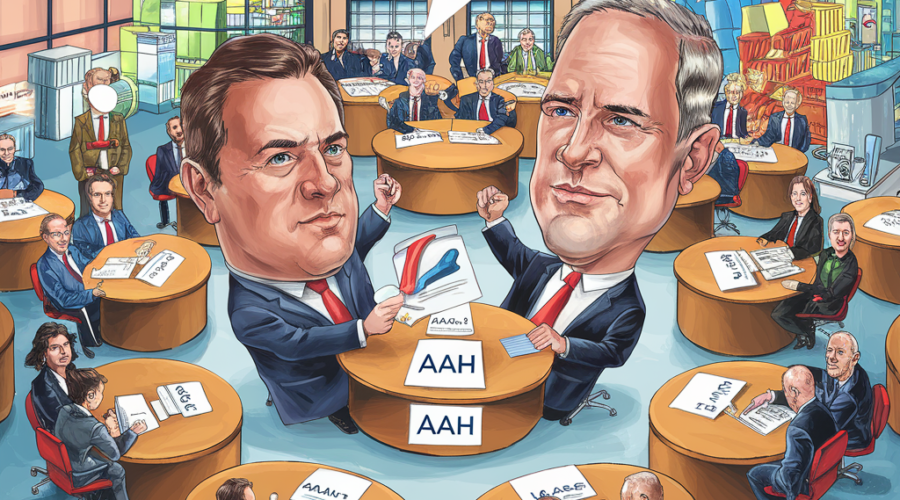

- Bidding War: Private equity giants HIG and CapVest have entered a high-stakes bidding war for AAH Pharmaceuticals, the UK’s largest pharmacy wholesaler.

- Company Profile: AAH services 14,000 pharmacies across the UK, generating £3 billion in annual revenue and delivering over 10 million items weekly.

- Valuation Expectations: Aurelius aims to sell AAH for around £900 million, nearly double the £477 million it paid for the entire McKesson UK business in 2021.

- Competitive Landscape: The UK pharmacy wholesaler market is highly competitive, with players like Phoenix and Alliance Healthcare vying for market share.

- Growth Under Aurelius: Despite controversies, AAH has seen a 60% increase in active customer accounts since 2022, demonstrating resilience.

- Strategic Implications: The auction outcome could reshape the industry, impacting employees, customers, and competitors through new investment strategies and operational efficiencies.

- Regulatory Concerns: Analysts highlight the need for careful consideration of operational and reputational risks in such deals, given regulatory challenges.

- Industry Trends: The auction reflects growing interest in strategic healthcare investments by private equity firms, signaling potential shifts in the sector.

- Stakeholder Engagement: As the process unfolds, engaging with industry experts and stakeholders is crucial to understand the evolving strategies and implications.

- Future Outlook: The auction’s outcome will be closely watched, offering insights into private equity firms’ strategic priorities in the healthcare sector.

References

Never miss top M&A news! Follow us