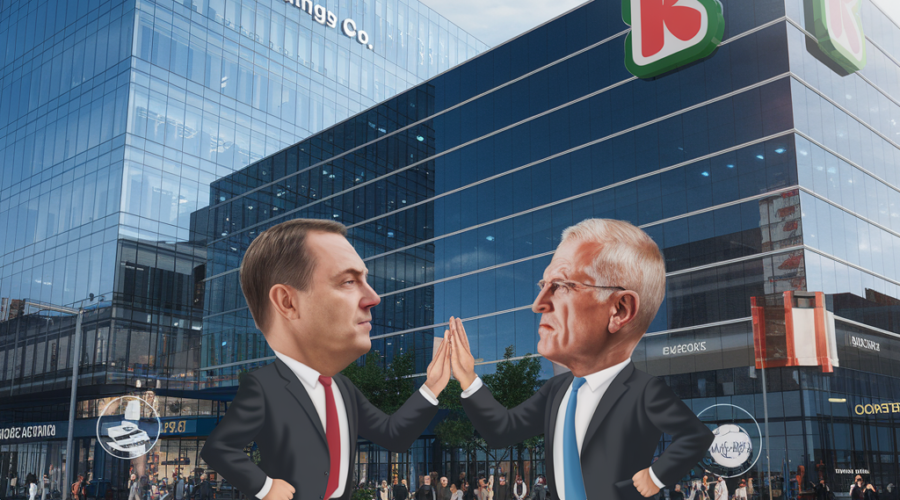

- Blockbuster Bid Rejected: Seven & i Holdings, the parent company of 7-Eleven, is set to reject a $35 billion takeover offer from Canadian convenience store giant Alimentation Couche-Tard.

- Strategic Misalignment: 7-Eleven’s board believes the offer undervalues the company and fails to account for its business strategy and potential antitrust issues.

- Retail Transformation: The convenience store industry is undergoing a digital transformation, with increasing demand for contactless payments and personalized services, as highlighted by a McKinsey report.

- Consolidation Landscape: The rejection could shape future M&A strategies in the retail sector, emphasizing the need for thorough due diligence and strategic alignment, according to Bain & Company.

- Brand Sentiment: Consumer sentiment towards the 7-Eleven and Couche-Tard brands will continue to play a crucial role in shaping the convenience store market, as per a BCG report.

- Historical Context: 7-Eleven has a complex ownership history, with past failed takeover attempts, such as the 2000 bid by a consortium of investors.

- Market Reaction: Despite antitrust concerns, 7-Eleven’s stock has seen a significant increase, indicating investor optimism about the company’s future prospects, as analyzed by Goldman Sachs.

- Competitive Landscape: Key players like 7-Eleven, Couche-Tard, and regional operators dominate the competitive convenience store market, influenced by economic factors like inflation and consumer spending habits.

- Growth Strategy: The rejection could prompt 7-Eleven to focus on organic growth and strategic partnerships, while Couche-Tard may reevaluate its acquisition approach.

- Future Outlook: As the retail landscape evolves, companies must adapt and innovate to remain competitive, potentially leading to further consolidation and strategic partnerships in the convenience store industry.

7-Eleven Owner Spurns Couche-Tard’s $35 Billion Takeover Bid Amid Strategic Misalignment