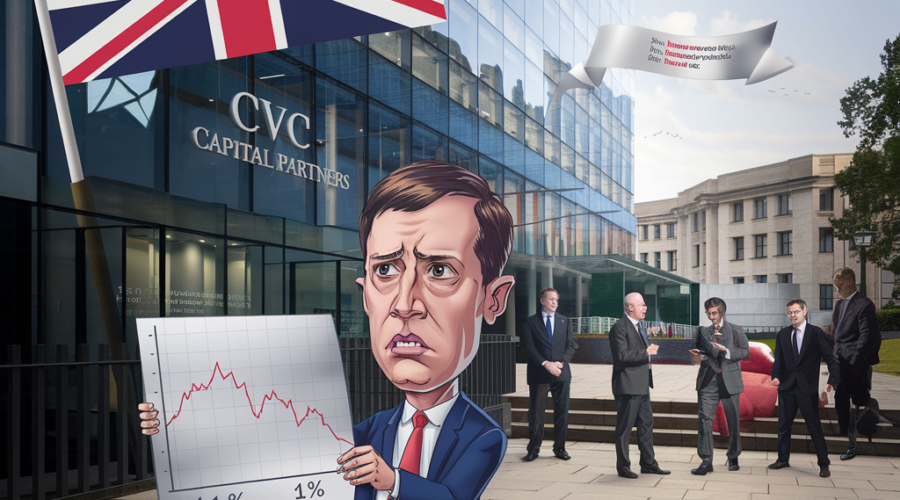

- Industry Alarm: Private equity giants like CVC are sounding alarms over the UK government’s proposed increase in carried interest tax rates from 28% to 45%.

- Compensation Structure Impact: Carried interest, a share of profits allocated to fund managers, is a critical component of private equity compensation that aligns manager and investor interests.

- Investment Behavior Shift: Higher taxes could lead to a significant shift in investment behavior, with firms potentially relocating to more favorable jurisdictions, impacting the UK’s competitiveness.

- Fundraising Concerns: The proposed changes raise concerns about reduced fundraising and investment activity in the UK, threatening the sector’s growth and economic contributions.

- Historical Precedents: Private equity firms have a track record of opposing unfavorable tax changes, as seen in the intense lobbying efforts against the 2017 US Tax Cuts and Jobs Act.

- Industry Advocacy: Associations like the British Private Equity & Venture Capital Association support some aspects but emphasize the need for careful consideration to avoid unintended consequences.

- Global Landscape Comparison: Different jurisdictions manage carried interest taxation differently, impacting the UK’s competitiveness as a hub for private equity investment.

- Strategic Adaptations: In response to tax changes, private equity firms may adapt strategies like structuring investments to minimize tax liabilities or exploring alternative jurisdictions.

- Constructive Dialogue: Engaging in nuanced discussions between industry leaders and policymakers is crucial to balance revenue needs with potential consequences for the private equity sector.

- Future Outlook: As the UK government moves forward, it must consider the long-term implications of its decisions on the future of private equity in the UK.

Private Equity Giant CVC Warns of UK Tax Plan Impact on Carried Interest