- Strategic Rejection: Wiz’s decision to reject Google’s $23 billion acquisition offer and pursue an IPO underscores its confidence in long-term growth potential and market dominance.

- Independence and Vision: By maintaining independence through an IPO, Wiz aims to execute its vision without constraints, signaling a commitment to innovation and market leadership.

- Brand Perception: The rejection enhances Wiz’s brand perception as a confident and ambitious cybersecurity firm, potentially attracting top talent and investors.

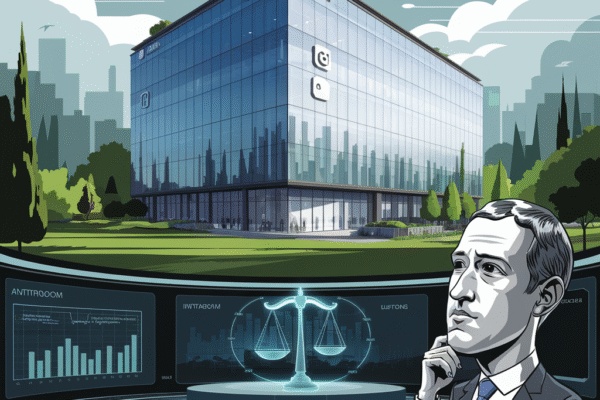

- Antitrust Concerns: Wiz’s leadership cited antitrust issues as a factor in rejecting Google’s offer, highlighting the complexities of tech acquisitions and regulatory scrutiny.

- Customer Traction: With 40% of Fortune 500 companies as customers, Wiz’s strong market position and growth trajectory position it well for an IPO.

- Historical Precedents: Wiz’s decision mirrors successful tech companies like Slack and Facebook, which rejected acquisition offers to maintain control and market presence.

- Optimal Timing: Wiz plans to pursue an IPO “when the stars align,” suggesting a strategic approach to timing and market conditions for maximum fundraising potential.

- Competitive Landscape: Google must reassess its cloud security acquisition strategy, while Wiz’s IPO could impact investor behavior and antitrust dynamics in the tech industry.

- Growth Trajectory: Analysts predict Wiz’s rapid expansion and market penetration will be closely watched leading up to its planned IPO.

- Industry Implications: Wiz’s strategic decision reflects the complexities and opportunities in the tech IPO landscape, where timing and vision significantly influence a company’s future trajectory.

Wiz Rejects Google’s $23B Offer, Confidently Pursues IPO: A Strategic Move?