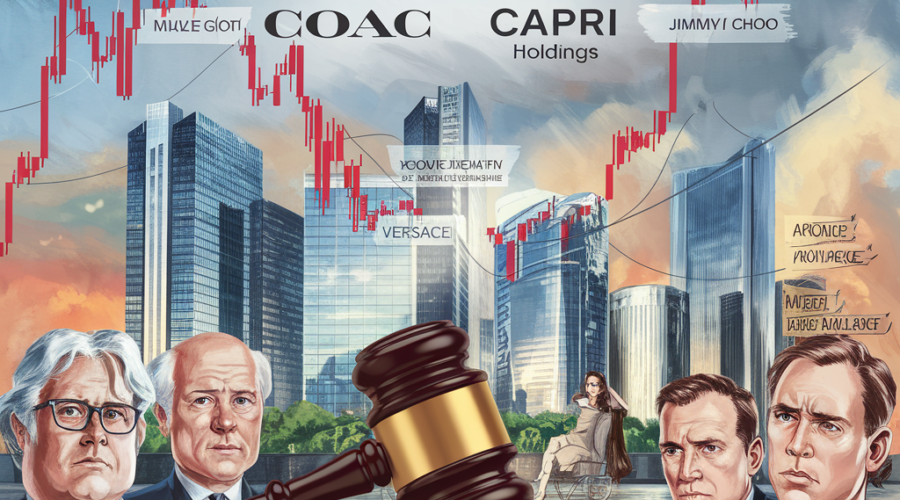

- Antitrust Scrutiny: The blocked $8.5 billion Tapestry-Capri merger highlights increasing antitrust scrutiny in the luxury fashion industry, as regulators aim to protect consumer interests and maintain competition.

- Legal Rationale: U.S. District Judge Jennifer Rochon ruled that the merger would undermine competition in the luxury handbag market, rejecting the companies’ defense that handbags are non-essential items.

- Market Impact: The ruling caused Capri Holdings’ shares to plummet by over 48%, while Tapestry’s shares rose by 13% in after-hours trading, highlighting the merger’s significance.

- Consolidation Trend: Luxury mergers and acquisitions have been a common trend, with notable examples like LVMH’s acquisition of Tiffany & Co. in 2021, but not all have been successful.

- Competitive Landscape: The ruling maintains competition between Tapestry and Capri, potentially benefiting consumers through price competition, but raises questions about the companies’ long-term strategies.

- Stakeholder Reactions: Executives at Tapestry and Capri plan to appeal the ruling, while industry insiders like Pauline Brown note the broader trend of increased antitrust scrutiny.

- Alternative Strategies: With the merger blocked, Tapestry and Capri may need to explore alternative strategies, such as smaller-scale acquisitions or strategic partnerships, to enhance their competitive position.

- Regulatory Environment: The evolving regulatory environment in the luxury fashion industry demands a nuanced approach to mergers and acquisitions, prioritizing both business strategy and legal compliance.

- Future Consolidation: Predictions suggest that future merger activity in the luxury space will be closely monitored by antitrust regulators, ensuring proposed deals align with consumer protection and competition laws.

- Conclusion: The blockage underscores the importance of maintaining competition in the luxury retail sector, and companies must adapt to changing regulatory environments and consumer demands.

Luxury Merger Blocked: Tapestry-Capri Deal Faces Antitrust Setback