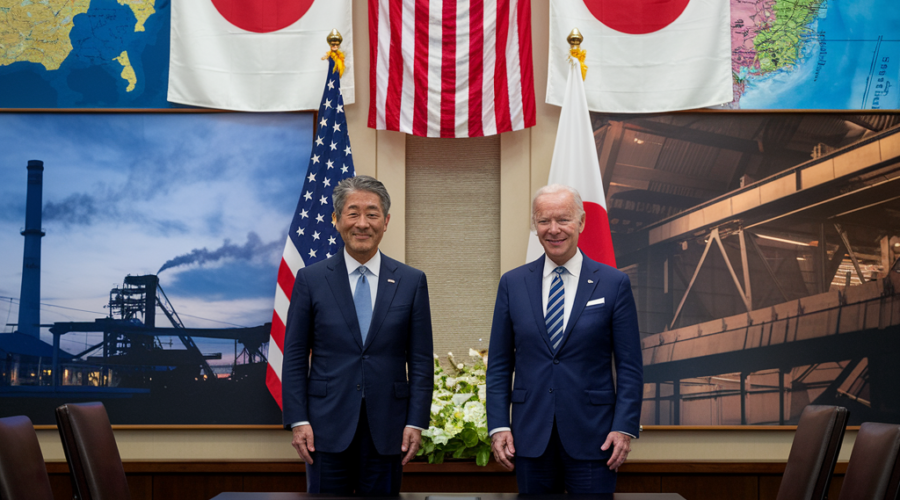

- Diplomatic Tensions: Japanese PM Shigeru Ishiba urges US President Biden to address concerns over blocked $14.9B Nippon Steel-US Steel merger deal amid strained bilateral relations.

- National Security Concerns: Biden administration cited importance of maintaining strong domestic steel industry, raising fears of job losses and reduced competitiveness for US Steel.

- Legal Battle: Companies file lawsuit alleging Biden’s decision was politically motivated, violating due process and undermining foreign investments in US markets.

- Global Supply Chain Impact: Blocked deal could disrupt highly interconnected global steel supply chains, affecting economies and exacerbating existing trade tensions, per McKinsey report.

- Economic Implications: Merger aimed to boost employment, production capacity; without it, US Steel may struggle, potentially leading to job cuts and reduced domestic output.

- Historical Context: Past events like Brexit, US steel tariffs impacted industry; Japanese investments traditionally viewed positively in US manufacturing sector.

- Geopolitical Factors: Deal highlights complexities of international trade amid shared US-Japan security concerns over China’s military presence in South China Sea.

- Domestic Political Fallout: Unaddressed concerns could further strain economic ties, diplomatic cooperation between US and Japan, affecting both leaders politically.

- Industry Insights: “Blocked merger could have long-term implications for global supply chains and competitiveness,” notes Goldman Sachs analyst on sensitive steel industry.

- Future Outlook: With legal action ongoing, next steps in negotiations crucial to determine deal’s fate and preserve economic alliance amid evolving global trade dynamics.

Japan PM Presses Biden on Blocked Steel Merger: Global Implications