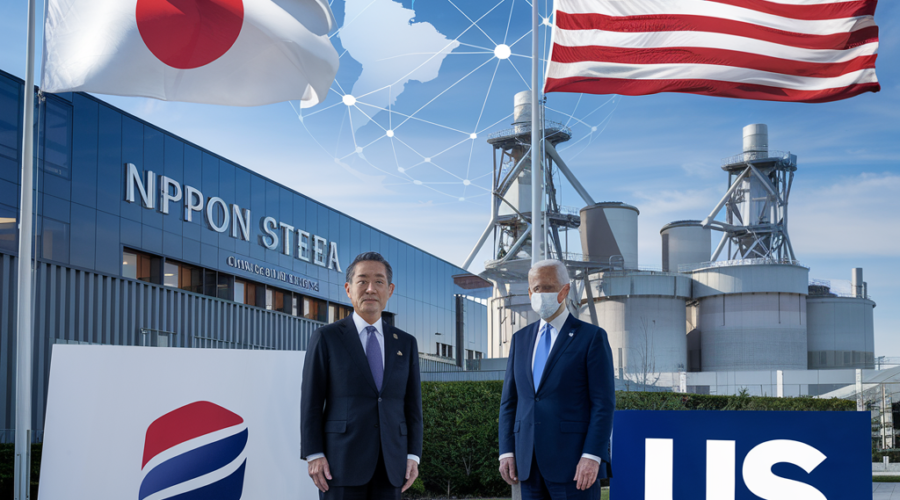

- Strategic Expansion: Nippon Steel’s $14.9 billion acquisition of U.S. Steel aims to bolster its presence in the Western market and enhance global competitiveness.

- Industry Challenges: The global steel industry faces intense competition from low-cost Chinese producers, making consolidation a strategic necessity.

- National Security Concerns: U.S. policymakers have expressed concerns about the deal’s potential impact on national security, leading to President Biden’s decision to block the takeover.

- Market Concentration: The merger could lead to increased market concentration, potentially benefiting consumers but challenging smaller steel manufacturers.

- Employment Impact: While the deal could drive domestic demand and employment, it also raises concerns about potential job losses and market disruptions.

- Historical Precedents: Previous major steel mergers, like Arcelor-Mittal in 2007, transformed the global landscape but faced regulatory hurdles and market concentration concerns.

- Geopolitical Dynamics: The success of the merger hinges on international trade agreements and U.S.-Japan relations, influenced by broader Indo-Pacific tensions with China.

- Expert Perspectives: Industry analysts and economists have varying opinions, with some seeing strategic benefits while others caution about potential risks and disruptions.

- Regulatory Hurdles: The merger review process is ongoing, with several steps ahead before a final decision, expected to be complex and potentially lengthy.

- Future Outlook: As the situation unfolds, CEOs and stakeholders must closely monitor developments, as the deal’s outcome could reshape the global steel market dynamics.

Japan PM Urges Biden: Address US-Nippon Steel Deal Concerns